Energy Uncertainty Continues to Drive Inflation

Energy uncertainty has become a key driver in unprecedented inflation in 2022. As the energy market becomes increasingly volatile, how will the continued bearish trends be mitigated?

Energy uncertainty has become a key driver in unprecedented inflation in 2022. As the energy market becomes increasingly volatile, how will the continued bearish trends be mitigated?

As inflation continues to rise to levels that have not been seen in nearly 40 years, in places such as Europe, the US and the UK, many people are questioning what is causing the huge increase in commodity pricing (i.e. our energy bills). The core driver of this is undoubtedly the energy uncertainty caused by a post pandemic surge in demand and the Russian war in the Ukraine reducing potential supply.

Russian Sanctions

Energy inflation has been rising steadily for almost a year now, initially the cause was post-pandemic supply shocks as industries began operating at full capacity once again. This was followed by the Russian invasion and subsequent war in the Ukraine, which has resulted in heavy sanctions being imposed on Russia. The US and many Western countries have banned the import of oil, liquefied natural gas (LNG) as well as coal from Russia as well as other commodities.

Both the UK and the EU are also set to phase-out Russian oil imports. The current aim is that Russian oil imports are set to be reduced by 90% in the EU by the end of 2022, with a tighter timeline for crude oil products. This has a huge impact on supply, as according to Eurostat, Russia supplies roughly 27% of the EU's imported oil annually. The UK are undertaking a similar stance in regards to phasing out Russian oil imports, furthermore, they are also considering banning natural gas imports.

Supply Concern Strategies

The EU is facing major challenges as it attempts to mitigate the impact of the transition to non-Russian fuel sources. There have been several different plans and strategies put forth to help close the demand gap, caused by the reduction in imports of Russian fuel. For example, Germany has triggered the second stage of a three part emergency gas plan to subsidise prices and safeguard supplies by encouraging big industrial customers to use less gas.

A primary strategy put forth by the EU in the short term is the liquefied natural gas (LNG) replacement strategy. There is enough LNG on the global market to cover the EU’s gas imports from Russia, however, LNG is a highly competitive commodity in today’s market. Europe has had a number of technical issues, as well as infrastructure and supply constraints in regards to obtaining liquefied natural gas (LNG), Europe currently only has sufficient infrastructure for approximately half the capacity of LNG that it needs, as LNG requires specialised terminals to receive it and convert it back to gas. Therefore, this is a long-term strategy rather than a solution for energy inflation in the short term.

Wholesale Electricity Markets Are Strongly Influenced by Gas Prices

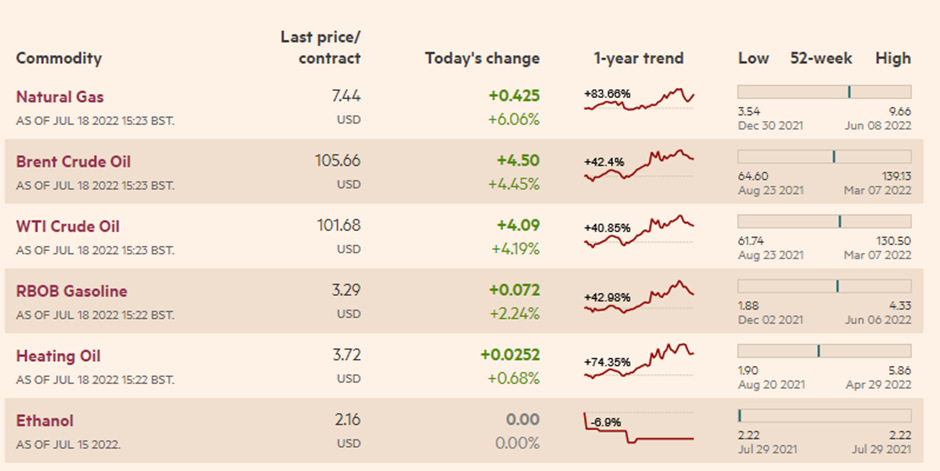

Natural gas tends to set the price of electricity in Europe, as gas continues to play a crucial role in balancing supply and demand for electricity on national grids. The supply issues means that the price of electricity increases due to uncertainty and demand pressure. The graph below shows that as of July 2022 that Natural gas has had a ~83% price increase in the past year. This is not even the highest point in the last 52 weeks as marked by the trend line on the right, June 8th marked the highest point of increase. However, the change is still trending upwards, which is concerning as governments begin to look at securing supply for the colder winter months.

Impact of Increasing Oil Prices

On June 11th the nationwide average gasoline price in the US topped $5.00 per gallon for the first time in history. This has a knock on effect across the wider market as oil prices affect the prices of other goods and services in a significant manner. Oil is the primary fuel source used for transportation, in the form of diesel, petrol, as well as marine and aircraft fuel. This influences the market as higher oil prices translates to higher transportation prices across the supply chain, for both goods and services, thus impacting the final consumer.

Energy Independence and Transition

German finance minister Christian Lindner has referred to renewable energies as “freedom energies''. By investing in sustainable energy systems, countries will in turn rely less on imports, as they will ideally create and use the energy from renewables such as solar, wind and hydro. However, significant drawbacks to this are that renewable projects require large capital investment and significant storage in order to ensure the electricity grid remains stable and secure.

The International Energy Agency (IEA) has remarked on how high fuel prices will result in significant profits for the fuel providers. These profits will provide enough capital to switch to investing in more low carbon technology and fuels. They stated that it is a “once in a generation” opportunity for big oil and gas companies to deliver on their net zero pledges. If these companies follow through on their pledges, this could mark a turning point in achieving a more sustainable energy system across various countries, including the UK, the US and Europe.

The EU has stated that the ‘case for a rapid clean energy transition under the European Green Deal has never been stronger and clearer’ as the energy supply of Europe becomes increasingly volatile, due to over-dependence on fossil fuels in particular from Russia. The current energy inflation is a clear sign that the energy sectors across the EU, the UK and the US need to change rapidly.

A meaningful commitment to renewables investment, and follow through action from both industry and governments is a clear solution to the current energy inflation crisis.

The transition to a sustainable energy future has never been more important.

Sources:

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220317_2~dbb3582f0a.en.html

https://www.uschamber.com/energy/energy-and-inflation

https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131