Quarterly International Carbon Update: Q4 2025

The verdict from COP30 is that climate action has moved outside the diplomatic arena, shifting the battlefield to markets, technology deployment, and corporate governance. For professionals in the energy and sustainability space, this dictates a new strategic focus.

In November 2025, COP30 (the 30th Conference of the Parties) was hosted in the Amazon gateway city of Belém, Brazil. Dubbed the "Implementation COP" and the "COP of Truth", it was intended to be a decisive moment in global climate action, shifting from aspirational pledges to verifiable execution.

After two weeks of intense negotiations, the summit concluded with a package of ratified decisions. But the resulting landscape is defined by a deep paradox – while unprecedented momentum and measurable results in climate finance, adaptation mechanisms, and non-state action are proceeding at full speed, the formal political process remains highly constrained by an inability to mandate a transition away from fossil fuels.

Climate action has moved outside the diplomatic arena, shifting the battlefield to markets, technology deployment, and corporate governance.

For professionals in the energy and sustainability space, this split reality dictates a new strategic focus.

The Mandate Shift

The Brazilian COP30 Presidency anchored the conference around the spirit of the Global Mutirão, a concept symbolising collective effort and co-operative, society-wide transformation. This philosophy defined the meeting's core goals: strengthening multilateralism, accelerating the implementation of the Paris Agreement, and connecting the climate regime to people’s daily lives.

The resulting Mutirão Decision, published 22 November 2025 and endorsed by nearly 200 countries, signalled a shift away from prolonged negotiation, emphasising that capital, data, and measurable outcomes should now drive climate action.

Progress on the Ground

The most comprehensive progress occurred outside the core negotiation tracks through the Global Climate Action Agenda (GCAA), which streamlined over 480 initiatives into 117 actionable Plans to Accelerate Solutions (PAS) aligned with the First Global Stocktake (GST-1).

Key areas of measurable progress include:

1. Mobilising Climate Finance & Investment

- New Global Target: Countries decided to urgently scale up global climate financing to at least USD 1.3 trillion per year by 2035 from public and private sources.

- Developed Country Commitment: Developed countries must remain on track toward mobilising at least USD 300 billion per year by 2035.

- Loss and Damage: The Fund for Responding to Loss and Damage (FRLD) was rapidly operationalised, issuing its first USD 250 million funding call for 2025–2026, marking an immediate step toward delivery.

- Renewables Investment: Partners advanced a USD 1 trillion investment plan to support tripling global renewable energy capacity by 2030.

- Adaptation Pipeline: The Fostering Investable National Planning and Implementation (FINI) for Adaptation and Resilience initiative partners announced USD 1 trillion in investible adaptation pipelines by 2028.

2. Scaling Adaptation & Resilience

- Finance Pledge: The commitment to triple adaptation finance by 2035 was ratified. However, critics noted this pledge lacks an agreed-upon baseline and pushes the deadline further out.

- Measurement: The Global Goal on Adaptation (GGA) indicators package was adopted, establishing the first comprehensive framework to track adaptation progress across water, health, food security, and ecosystems. This immediately translates into intensified disclosure requirements for relevant sectors.

- Just Transition Mechanism: A decision was adopted to establish a formal Just Transition mechanism to foster international co-operation, incorporating the strongest language yet on Indigenous and worker rights.

- NAP Acceleration: The National Adaptation Plan (NAP) process has shown measurable acceleration, shifting from planning to submission, with 67 developing countries having submitted their completed NAPs as of September 2025, and 144 countries having initiated the process.

3. Nature & Ecosystem Stewardship

- Forest Finance: The Tropical Forest Forever Facility (TFFF) was operationalised, securing USD 5.5 billion in initial pledges and setting a precedent by earmarking at least 20% of its resources directly for Indigenous Peoples and local communities.

- Ecosystem Protection: Countries renewed commitments, delivering early on the USD 1.7 billion land-tenure pledge and advancing protection across 160 million hectares.

- Ocean Action: The Blue NDC Challenge gained 17 country members, and the One Ocean Partnership aims to mobilise USD 20 billion of investment by 2030 for ocean-based solutions.

4. Industry Decarbonisation & Super Pollutants

- Sustainable Fuels: The 4x Pledge on Sustainable Fuels aims to quadruple the production and use of sustainable fuels (including hydrogen, e-fuels, and biofuels) by 2035 to decarbonise hard-to-abate sectors.

- Methane Action: The Super Pollutant Country Action Accelerator was launched by Brazil and the UK to help 30 developing countries cut emissions of methane and black carbon by 2030. This reinforces the expectation that methane (CH4) will become a core performance and compliance metric for energy and agricultural companies.

The Mitigation Paradox

The United Nations Framework Convention on Climate Change (UNFCCC) Synthesis Report on Nationally Determined Contributions (NDCs), published 28 October 2025, provides the cold data backdrop against which all this implementation must be measured. The findings confirm that while commitment quality is rising, the aggregate effect of current pledges still fails to meet the scientific imperative.

The report analysed 64 NDCs submitted ahead of the February 2025 deadline, covering ~30% of total global emissions in 2019. The paradox is stark: markets are scaling solutions at speed (GCA), but political pledges (NDCs) still lead towards a dangerous level of warming.

- Projected Emissions Reduction: Collectively, the 64 new NDCs project a reduction of 17% below their 2019 level by 2035 (with a full implementation range of 11–24%).

- Ambition Gap: This trajectory is fundamentally insufficient. The IPCC requires emission reductions of 60% below the 2019 level by 2035 to align with the 1.5°C goal.

- Warming Trajectory: Current UN analysis, informed by these NDCs, still points to a global warming trajectory of 2.3–2.8°C.

- NDC Quality: The quality and credibility of NDCs are improving: 89% of Parties communicated economy-wide targets. And 89% of Parties plan to or may use Article 6 carbon market mechanisms in implementation, signalling potential growth in international carbon trading.

The Fossil Fuel Impasse

The summit’s single biggest diplomatic failure appeared to be the inability to secure binding language on transitioning away from fossil fuels, illustrating the deep constraints of consensus-based multilateralism.

Despite the Brazilian presidency's efforts and strong backing from over 80 countries for a fossil fuel roadmap, the final decision text did not contain a single reference to coal, oil, or natural gas, nor did it include a binding roadmap for phase-out.

Although a binding text failed, Brazil initiated voluntary presidential roadmaps on fossil fuel transition and deforestation to continue high-level dialogues, and present results at COP31, in Antalya, Türkiye, November 2026. However, participation is voluntary and these initiatives stand outside the ratified UN climate framework.

The resulting message is clear: when multilateralism stalls, the impetus for structural change falls directly onto national governments, markets, and coalitions of the willing.

Capital is Scaling Clean Energy Faster Than Diplomacy Ever Will

The global energy transition is being driven primarily by rational economics, technology deployment, and private capital, rather than diplomatic consensus. Decarbonisation is no longer a niche effort, but an operational reality embedded in global supply chains and demanded by many investors.

Specific technological progress includes:

- Solar Growth: Solar power has been the largest source of new electricity generation globally for the last three years.

- EV Mainstreaming: Electric vehicle adoption is rapidly cutting oil demand, displacing over 1.3 million barrels per day in 2024 – about the same as Japan’s entire transport oil use. By 2030, EVs are projected to displace more than 5 Mb/d, with China accounting for half of the reduction. Light-duty EVs currently drive about 80% of this impact, though their share will fall slightly to 77% as electric trucks and buses grow, together displacing nearly 1 Mb/d by 2030.

- Grid Resilience: Global battery storage capacity surged in 2023, and is projected to multiply exponentially by 2030 due to plummeting costs. The Utilities for Net Zero Alliance (UNEZA) has expanded its scope, pledging USD 66 billion annually for renewable energy and USD 82 billion for transmission and storage projects.

Imperatives for the Energy & Sustainability Professional

The mixed outcomes of COP30 – accelerated implementation alongside critical political failures – translate into three mandatory strategic imperatives for those operating in the sustainability and energy domain.

1. Finance is Scaling

The finance system is rapidly aligning around quantifiable climate risks and opportunities. The USD 1.3 trillion annual climate finance goal by 2035 demands that organisations pivot from incremental project funding to developing large-scale, programmatic investment pipelines.

- Investment Readiness: The sheer scale of planned capital mobilisation, including the USD 1 trillion announced for adaptation pipelines by 2028, puts pressure on organisations – especially in emerging markets – to develop investible adaptation projects with clear risk/return profiles, turning NAPs and NDCs from policy documents into financial products.

- New Revenue Streams: The ramp-up in finance, particularly in adaptation (tripling by 2035), nature (TFFF), and sectoral decarbonisation (Super Pollutants, Sustainable Fuels), creates significant market opportunities for organisations providing solutions in resilience infrastructure, regenerative landscapes, and non-CO2 abatement technologies.

- Article 6 Integration: The finding that 89% of new NDCs intend to use Article 6 mechanisms confirms that carbon markets remain highly relevant for achieving near-term mitigation targets and mobilising private finance. Organisations must ensure their offset strategies align with emerging regulatory clarity and robust data integrity.

2. Reporting Intensifies

The era of vague ambition is ending. The focus on implementation is tightening disclosure and verification requirements, transforming sustainability reporting into an exercise in operational accountability.

- Adaptation Disclosure: The adoption of the GGA indicators means that organisations exposed to physical climate risk now face increased disclosure requirements on adaptation planning, progress, and financial exposure across key areas like water, health, and ecosystems.

- Pollutant and Value Chain Verification: Initiatives targeting methane and other "super pollutants" mean that environmental performance in energy, agriculture, and waste management will shift to become core compliance metrics. This mandates robust Measurement, Reporting, and Verification (MRV) systems, as traceability and data integrity across complex global supply chains become essential for demonstrating verifiable results.

- Whole-of-economy Integration: The overall message of the Mutirão – that climate action must deliver measurable results – requires companies to integrate decarbonisation as a core business capability, linking executive compensation to emissions performance, and implementing a broad array of solutions.

3. Trade is in Play

For the first time, trade was formally included as a pillar of the final text, signalling a profound linkage between international commerce and climate ambition.

- CBAM Scrutiny: The agreement includes a three-year dialogue to address unilateral trade measures and carbon border adjustments, directly signalling incoming scrutiny of carbon-intensive goods and the potential evolution of mechanisms like the EU Carbon Border Adjustment Mechanism (CBAM).

- Global Supply Chain Risk: For organisations with complex global footprints, this dialogue increases regulatory uncertainty and mandates proactive risk planning related to carbon pricing and border adjustments. Achieving compliance and maintaining market access will require developing best practices for monitoring and verifying emissions across the entire supply chain.

Key Takeaways for Energy & Sustainability Professionals

The dual reality of post-COP30 mandates a strategy focused on rigorous execution and measurable results, regardless of slow-moving policy:

• Prioritise Execution and Verification: Implementation is the new metric of success. Invest in robust MRV capacity to meet tightening requirements under the new GGA indicators and Article 9 scrutiny. Methane and other super pollutants are becoming core performance and compliance metrics.

• Capital is the Primary Driver: The USD 1.3 trillion annual finance commitment signals that capital is flowing to investable solutions, especially in renewables, storage, and adaptation projects with clear financial profiles. Organisations must align their strategies with this massive financial shift.

• Geopolitical Risk Translates to Commercial Risk: The failure to secure binding fossil fuel language means policy uncertainty persists. Simultaneously, the new focus on trade and mechanisms like CBAM puts global supply chains and carbon-intensive goods under regulatory threat.

• The Transition is Structural: Decarbonisation is no longer a peripheral effort but an operational reality embedded in global value chains and driven by the economic superiority of clean energy technologies. The accelerated action of markets and non-state actors is filling the void left by political consensus failure.

Q4 2025 Headline News

Global

18 November 2025: Demand from major tech firms – driven by rising emissions from AI/data centre growth – is rapidly depleting supply of high‑quality carbon‑removal credits, particularly from durable solutions like biochar and direct air capture. As a result, prices for these durable credits have surged (almost four‑fold by 2024 compared with cheaper forest‑preservation offsets), and many buyers are now turning to long‑term offtake agreements or even building their own carbon‑removal capacity to secure supply. For the broader energy and sustainability field, this dynamic underscores how corporate net‑zero ambitions are transforming the carbon‑removal market – increasing competition for high‑integrity credits and accelerating investment in scalable removal technologies.

18 November 2025: Imperial College London launched the London Register of Subsurface CO2 Storage – the first comprehensive, publicly accessible scientific database (1996–2024) detailing how much CO2 has been permanently stored underground globally through Carbon Capture and Storage (CCS). It shows that over 383 million tonnes of CO2 have been securely sequestered – equivalent to removing the annual emissions of ~81 million petrol cars. The data covers 35 operational CCS projects across nine countries, with recent years seeing record annual storage (~45 Mt CO2 in 2023), signalling robust, accelerating global deployment. By offering a verified, transparent baseline, the Register strengthens the case that large‑scale geological CO2 storage is already proven, scalable, and ready to play a central role in decarbonising hard‑to‑abate sectors – a critical insight for organisations, regulators, and investors shaping energy transition strategies.

20 November 2025: Institutional investors remain strongly committed to sustainable investing: 86% of asset owners and 79% of asset managers expect their allocations to sustainable assets will increase over the next two years. They view sustainability not as a fringe add‑on but as a key differentiator and a core part of managing long‑term investment risk. Climate considerations are increasingly shaping asset strategies: over 75% of respondents expect physical climate risks to significantly affect asset prices within five years, while investment in climate adaptation (e.g. grid resilience, water infrastructure, data/analytics) now ranks among the top priorities globally. At the same time, institutional investors signal growing concern over structural impediments – especially inconsistent data availability, lack of regulatory clarity, and political uncertainty – which they see as the most significant barriers to scaling sustainable investments.

10 November 2025: Isometric has secured full approval from ICAO to issue carbon‑removal credits that airlines can use to satisfy CORSIA obligations, marking a significant credential for the registry. This approval comes after a rigorous evaluation – Isometric met ICAO’s standards for transparency, scientific rigour and environmental integrity. With demand for aviation‑sector removals projected to hit ~500 million tonnes annually by 2050, this expands supply of high‑quality, verifiable removal credits – potentially boosting credibility of offsets and stimulating investment in robust carbon removal projects.

October 2025: The Climate Financial Risk Forum published A Risk Professional’s Guide to Physical Risk Assessments: A GARP Benchmarking Study of 13 Vendors, showing substantial divergence across the 13 leading data-vendors in how they model and quantify physical climate risks at the asset level. What counts as “high exposure” (e.g. to floods, storms, heat) from one vendor may appear negligible under another. This variability stems from differences in key factors like hazard definitions, climate scenarios, spatial granularity, asset-location precision, and assumptions about vulnerability and damage. As a result, risk estimates (hazard severity + damage potential) are highly sensitive to vendor choice – reinforcing there is no one-size-fits-all “best” model. For energy and sustainability professionals, and investors evaluating real-estate portfolios, that means any climate-risk assessment relying on such vendor data should be approached cautiously: due diligence, transparency on assumptions, and, ideally, internal expertise remain essential to reliably interpret and act on physical-risk outputs.

AMER (North, Central, & South America)

4 December 2025: The Trump administration proposed a sweeping rollback of federal fuel-economy and tail-pipe emissions standards – part of a broader effort to reverse clean-transport policies introduced under the previous administration. The new proposal would scrap the 2031 fleet-wide target of ~50.4 mpg (≈ 4.7 L/100 km) for cars/trucks and replace it with a much weaker 34.5 mpg average, drastically reducing incentives for fuel efficiency and electric-vehicle adoption. This marks a significant policy shift away from clean-transport ambition – favouring conventional internal combustion engine (ICE) vehicles – with likely consequences including increased gasoline consumption, higher tail-pipe emissions, and a slowdown in the momentum toward decarbonised mobility. The Environmental Protection Agency (EPA) has also proposed – and will likely soon finalise – the elimination of climate pollution limits on cars and trucks. Automakers that neglect smaller cars and electric vehicles could, however, be vulnerable if oil prices rise, and risk falling out of sync with global EV markets.

20 November 2025: A recent ruling by the US Court of Appeals for the Ninth Circuit has temporarily blocked enforcement of California Climate‑Related Financial Risk Act (SB 261), which would have required large companies doing business in California to publicly disclose their climate‑related financial risks from 1 January 2026. However, the companion law – California Climate Corporate Data Accountability Act (SB 253) – remains in force; firms with revenues above USD 1 billion are still required to report their greenhouse‑gas emissions (including indirect, Scope 3 emissions) under SB 253. The split outcome introduces regulatory uncertainty for companies preparing for compliance – SB 261’s timeline is now paused pending appeal, while SB 253 is proceeding, with regulators targeting an initial reporting deadline of 10 August 2026. From an energy and sustainability perspective, this underscores continuing momentum toward mandatory emissions disclosure but highlights legal and compliance risk around mandated climate‑risk reporting.

26 September 2025: The state California Air Resources Board (CARB) has published a preliminary list of roughly 4,160 companies – including most of the S&P 500 – that will be subject to mandatory climate‑disclosure laws. Under SB 253, firms with annual revenues over USD 1 billion doing business in California must begin reporting their direct (Scope 1 and 2) emissions in 2026 and their indirect (Scope 3, value‑chain) emissions in 2027. Meanwhile, SB 261 requires companies with revenues over USD 500 million to disclose climate‑related financial risks (e.g. from extreme weather, transition risks) and their mitigation strategies – with the first reports due by 1 January 2026. The scope of the legislation extends beyond California‑headquartered firms, capturing many multinationals with global operations, which means the laws may become a de facto US climate‑disclosure standard in the absence of comprehensive federal rules. For energy‑sector players or supply‑chain‑heavy businesses, this signals that regulators and investors are increasingly demanding transparent, comprehensive greenhouse‑gas accounting – and that Scope 3 emissions and climate‑financial‑risk disclosure are now moving from voluntary to regulatory baseline.

APAC (Asia & Pacific)

1 December 2025: The International Energy Agency (IEA) convened nearly 150 energy‑efficiency practitioners and policymakers from 12 Southeast Asian countries for its latest Energy Efficiency Policy Training Week in Hanoi, Vietnam. The event is part of IEA’s wider push to make energy efficiency the “first fuel,” underlining its value as one of the fastest, most cost‑effective levers to meet rapidly rising regional energy demand. The training – covering buildings, industry, transport, equipment, and monitoring/evaluation – feeds into global efforts to double energy‑efficiency gains by 2030 under the IEA’s Emerging Economies programme.

29 November 2025: The IEA’s World Energy Outlook estimates that the South Asian bloc, led by India, will be the main driver of energy demand. These stats come at a time when green energy sources are experiencing increased demand in India’s domestic market. Rising heat – and the resulting surge in electricity demand for cooling – is accelerating energy demand growth in India; at the same time, rapid expansion in renewables (mainly solar and wind) is transforming the power-generation outlook. As a result, India has reached roughly half of its installed capacity from non-fossil fuels well ahead of its 2030 target. However, infrastructure – especially transmission, grid integration, and storage – is lagging behind capacity growth, raising concerns about whether the clean power build-out can be fully absorbed and reliably dispatched.

24 November 2025: The 15th Five‑Year Plan represents a shift for China’s real‑estate sector, from speculative growth to “high‑quality development,” with a strong green and ESG focus: the plan aims to establish about 100 national zero‑carbon industrial parks by 2030, applying energy‑efficiency, low‑carbon design and sustainability criteria across new offices, industrial parks, logistics centres, retail and residential buildings. Demand is expected to grow for industrial and office real estate serving emerging “productive forces” – notably clean‑tech, renewables‑adjacent manufacturing (e.g. EV, biotech, AI) – which will help scale up low‑carbon industrial infrastructure. The Plan also reframes real estate as a “livelihood sector,” with emphasis on affordable housing, rentals, urban renewal and social infrastructure – signalling a tilt toward socially and environmentally responsible development over pure speculative investment. For sustainability‑minded investors and energy professionals, this underscores a major opportunity: Chinese real estate is positioning to become a large, policy‑backed market for low‑carbon buildings, retrofits, green logistics, data‑centre campuses and ESG‑integrated assets – potentially mobilising significant capital toward decarbonising one of the world’s biggest built‑environment markets.

12 November 2025: China’s CO2 emissions have held roughly flat for the past 18 months – even as the economy and power demand have continued growing – signalling a potential turning point in its emissions trajectory. The stability is driven by a record surge in clean‑energy deployment (notably solar, wind, nuclear and hydro) and rising efficiency/electrification in industry and transport, which are offsetting demand pressures. That said, emissions remain at near‑peak levels, and ongoing coal‑plant construction plus carbon‑intensive industrial activity mean the trend is fragile – a rebound remains possible. For global energy and sustainability professionals, China’s 18‑month plateau offers cautious optimism: it demonstrates that rapid clean‑energy scaling can decouple growth from emissions – but also underscores that deep decarbonisation will require sustained structural shifts beyond renewable rollout.

EMEA (Europe, Middle East, & Africa)

3 December 2025: The EU formalised a legally binding plan to phase out all imports of Russian natural gas – both pipeline-gas and liquefied natural gas (LNG) – by late 2027. Under the landmark agreement, aimed at ending the bloc’s long‑standing reliance on Moscow for energy, imports under new contracts will be banned starting in 2026; short‑term Russian gas contracts will be terminated by mid‑2026; LNG imports must cease by end‑2026; and all remaining long‑term pipeline‑gas contracts must end by autumn 2027 (with a potential one‑month extension if EU gas storage levels are not sufficient). This move is part of the wider REPowerEU strategy to strengthen energy security, reduce geopolitical risk, and accelerate Europe’s shift toward diversified and lower‑carbon energy sources.

27 November 2025: The UK's top experts mounted an official National Emergency Briefing (NEB) of politicians and civic leaders on the latest science, to galvanise action on the climate and nature crisis. Ten leading scientists and specialists provided a high-level summary of the most pressing threats and solutions, warning that climate change, biodiversity loss, and ecological collapse already pose major risks – from extreme weather, food insecurity, and public health stress, to economic instability, infrastructure disruption, and national security threats. The call for urgent systemic action sounded loud and clear: nature must be treated as critical infrastructure, public and private finance redirected toward restoration, and disclosure of climate/nature‑related risks made mandatory for regulators, investors, and businesses alike. A broadcast-quality documentary, with footage from the event, will be screened in communities across the UK from early 2026.

5 November 2025: The EU struck a compromise deal committing to a binding 2040 target of cutting greenhouse‑gas emissions by 90% relative to 1990 levels – a major milestone toward its 2050 net‑zero ambition. As part of the compromise, member states may use international carbon credits to cover up to 5% of the reduction (effectively domestic cuts of 85%), with a possibility to allow a further 5% under emergency conditions – a notable expansion from the initial 3% limit. The deal also establishes a new interim 2035 target – a 66.25–72.5% reduction compared with 2019 – to bridge the gap between the 2030 and 2040 goals. For energy‑sector and sustainability professionals, this means a clear long‑term policy trajectory – but also continued options on carbon‑market mechanisms and offsetting, with potentially smaller incremental pressure on domestic emissions reductions than previously expected.

ICYMI: Free Mapping Tool to Monitor the World’s Clean Energy Transition

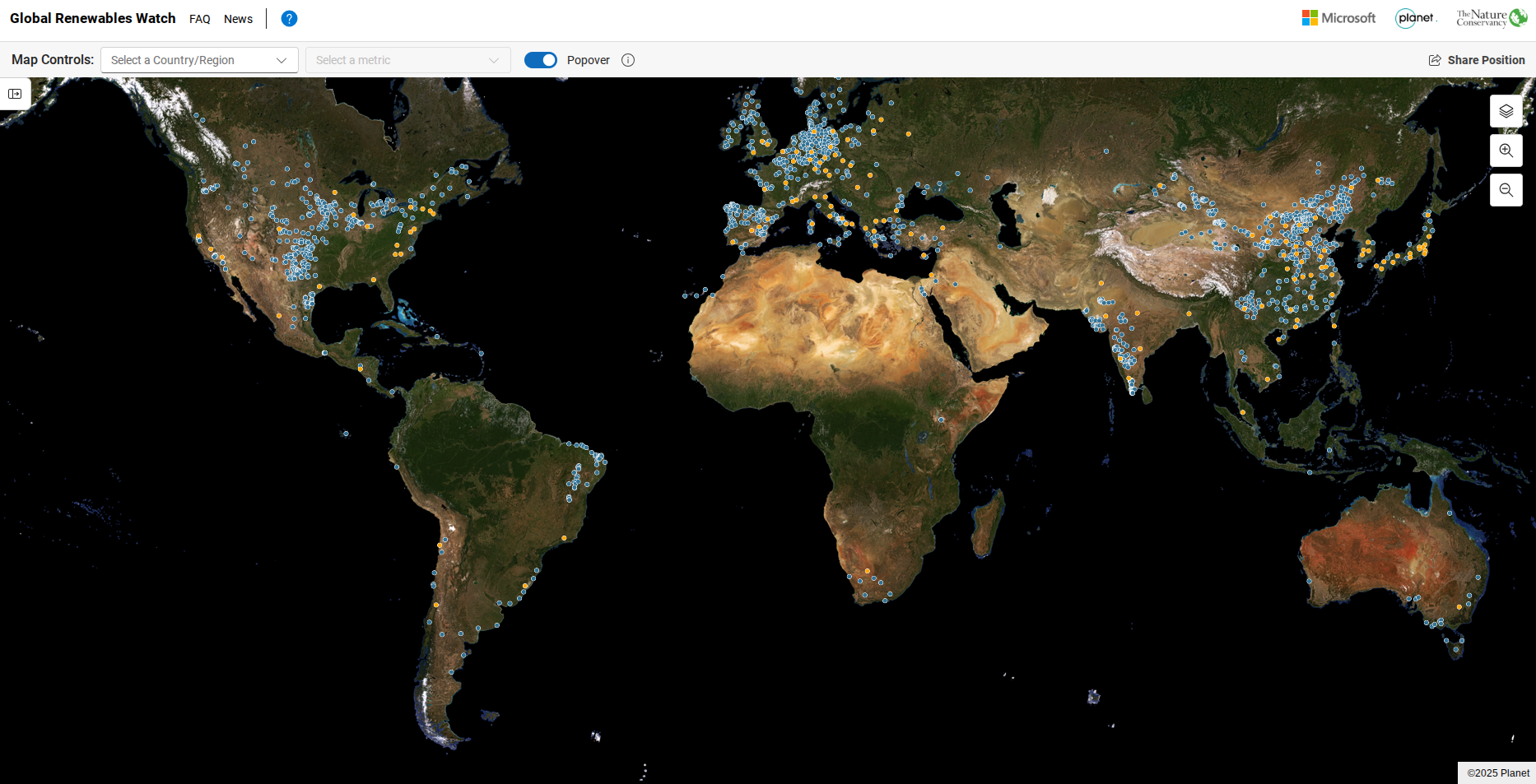

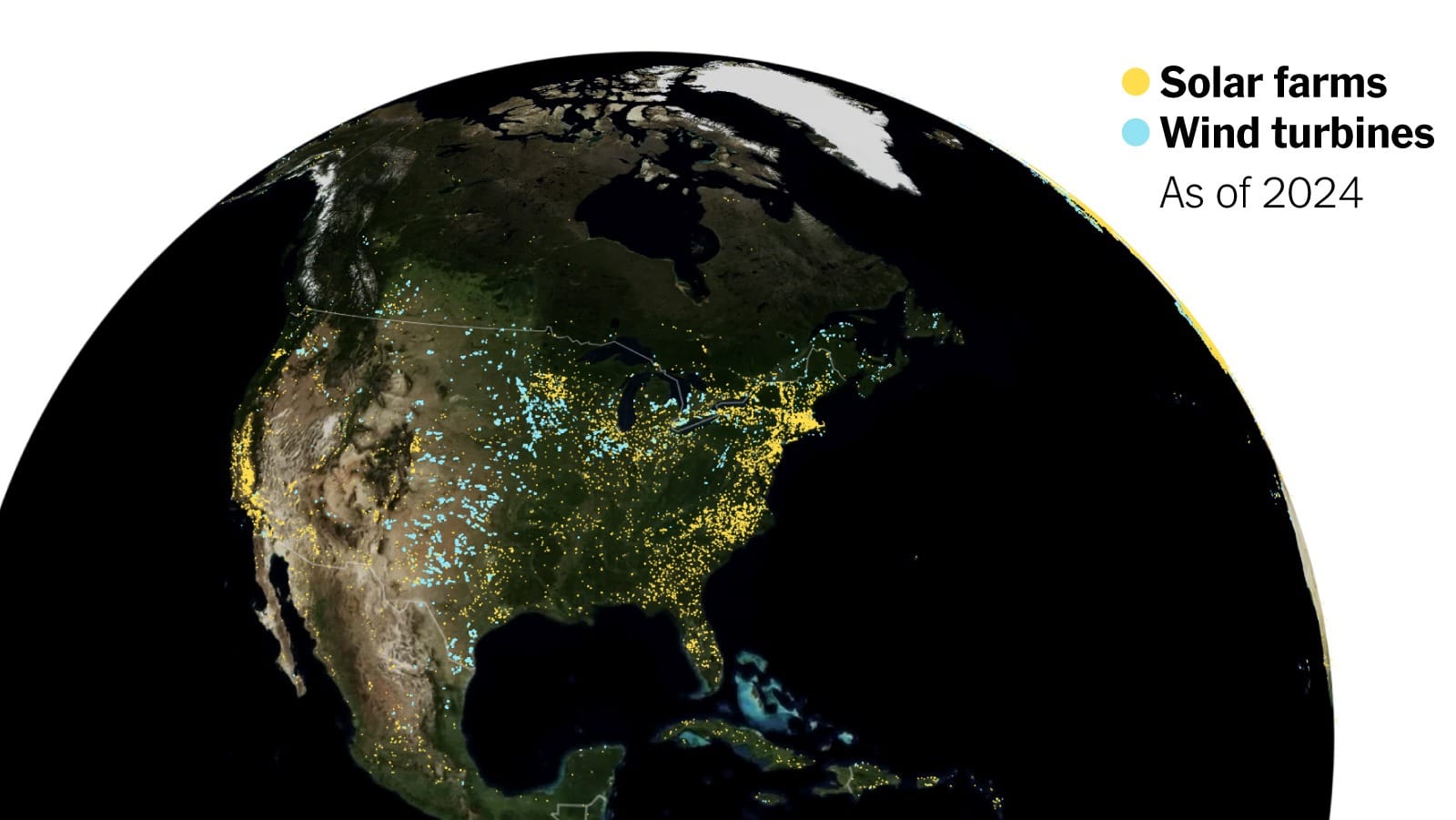

In case you missed it: Global Renewables Watch – a first-of-its-kind ‘living atlas’ of commercial solar photovoltaic (PV) farms and onshore wind turbines across the Earth – went live to the public earlier this year.

A collaborative initiative between Planet, Microsoft, and The Nature Conservancy (TNC), this data-rich platform was made possible by combining Planet’s satellite data, Microsoft’s advanced AI technology, and TNC’s renewable energy subject matter expertise.

The comprehensive global temporal dataset, derived from high-resolution satellite imagery analysed quarterly from the fourth quarter of 2017 to the second quarter of 2024, offers crucial insights into progress toward sustainable development goals (SDGs), and serves as a valuable resource for policymakers, researchers, and stakeholders aiming to assess and promote effective strategies for renewable energy deployment.

If you found this analysis interesting, be sure to subscribe to our quarterly LinkedIn Newsletter. Our next Carbon Update will be published at the end of Q1 2026.